In this article we will talk about the company an interesting glimpse into china's plans for its renewables industry.

|

| China's plans for its renewables Energy industry |

china's biggest IPO of 2021 so far is not some super sexy semiconductor player or mobile app but rather a renewable energy company with a very familiar name that company is called three gorgeous new energy and it is a subsidiary of china's three gorgeous corporation builder of the world's biggest dam.

in june 2021 the company sold 8.57 billion shares on the shanghai stock exchange to raise 22.5 billion RMB or 3.5 billion USD. as

of this writing in august 2021 the unit

is worth about 160 billion RMB or 24.5

billion USD.

it trades under the stock ticker shanghai SH:600905 which means americans can't buy this and americans shouldn't buy this because this is a company profile not an investment brief.

Intro to three Gorges Renewables

the name is a little deceiving the business unit does not actually own or operate the three gorgeous dam. the

operations associated with the company's

eponymous dam belongs to a sibling

company -china yangtze power.

rather three gorgeous new energy builds and operates wind and solar farms it had once been a state-owned corporation within the ministry of water resources working on water conservation methods.

three gorgeous corporation then bought it and for whatever reason turned it into the renewable energy resources vehicle

the company still has some very small

hydropower projects left.

wind provides about 55 percent of revenue onshore about 47

and offshore about 8 percent.

solar provides most of the rest about 44.

About Three Gorges Corporation, the majority Owner

three gorgeous new energy is 74.9 directly and indirectly owned by china three gorgeous corporation, I’m going to call

it CTG for the sake of brevity.

CTG is a power industry development company,

when the party decided that it was going

to build a dam across the three gorges

they established CTG to do

the construction.

After the dam was completed CTG then

founded another subsidiary “china yangtze power” to operate and receive

the cash flows from the three gorgeous

dam.

yangtze also operates other dams on the yangtze river including the Xiluodu and

the xiangliaba dam.

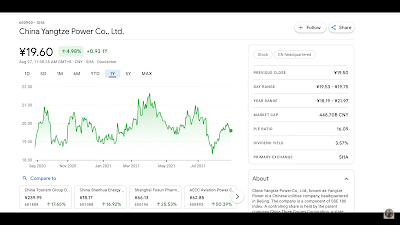

yangtze power now publicly trades on the shanghai stock market under the ticker symbol 600900

as of this writing the company's market

cap is 449 billion RMB or 69 billion USD. it

yields an annual dividend of 3.57

percent.

The question is why two

subsidiaries why didn't CTG

simply roll its solar and wind energy

plays into yangtze energy yangtze is already a large well-established public company after all.

I cannot pretend to

know what they're thinking but I reckon

that it has to do with policy and

growth the Chinese government is pushing

the development of quote-unquote new

energy sources. it classifies new energy has wind, Solar, Tidal and water power without regulation capability whatever that means.

hydropower is not included and so does not receive the same treatment and feeding tariffs so it's not really a growth stock.

china is the most damned country in the world they have been damning since the days of Mao.

not that many more dams to build.

the two companies PE

ratios as of this writing reflect

this through gorgeous new energy as a

38.8 ratio while yang c has 16.

the utility has been

expanding its portfolio quite

rapidly in 2008 the company had about

143 megawatts of installed capacity, at the end of September 2020 that

number has grown 12 times over to 11,900 megawatts an annual growth rate of 45.7 percent.

this trend is expected to continue as china's 14th five-year plan dictates the quadrupling of total installed renewable energy capacity from 2021 to 2025.

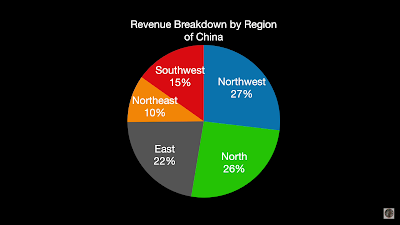

the company has projects in 30 provinces autonomous areas and municipalities across the country the majority of its revenue derives from china's north northwest and east.

Offshore Wind and Solar

the party has set a path for china to be a leader in offshore wind energy thus this is a special focus for the company. three gorgeous new energy is in the midst of quote unswervingly implementing the strategy end quote as they so often like to say in Chinese media.

the company estimates that by the end of 2020 total installed and in production capacity of offshore wind power will reach 4,270 megawatts which assuming they hit that number would be as much as what japan has in total overall installed wind capacity.

Offshore wind projects are more complicated than their onshore counterparts they require engineers to deal with confounding factors like sudden severe weather, icing issues, deep

water and complex seafloor topography.

this is the company's chosen core competency so they are doing the end-to-end installation all by themselves

it has required them to build amongst

other things.

china's first indigenous

submarine cables and sea booster stations which is a kind of dredging machine.

the company has also been doing some interesting things to best make use of old coal mine infrastructure. in the

city of Huainan in the Anhui province

the company has set up a 150-megawatt floating solar installation in the “Panyi

coal mine”.

Industry Dynamics: Costs and Margins

we can boil down the renewable energy industry into three large sections; we have

the upstream components makers, the

midstream manufacturers and the downstream

end users.

china's solar efforts the renewable energy industry's value chain between these three sectors kind of looks like a horseshoe.

upstream component makers often hold very specialized knowledge and thus can charge high margins for their work. downstream

providers hold the critical customer

relationship and midstream makers

thus are worse off between the three

they are first in line to eat price cuts

when things go bad.

three gorgeous new energy used to manufacture and sell their own wind turbines but in 2017 they withdrew from this business and fully committed to developing power generation plants. the

company has gross margins approaching

60 furthermore these margins are

rising year after year a trend that

roughly begins after the 2017 decision

to withdraw from turbine manufacturing.

we can also tie these rising gross margins to cheaper wind turbines the company procures them from two major suppliers “Xinjiang Goldwind” and “mingyang” smart

energy.

three gorges appears

to be holding their feet to the fire. this

trend of course can't last forever at

some point we're going to hit some red

line where turbine and solar costs

cannot decline any further, until then though it looks like the utility gets to reap the benefits of the improving economies.

Industry Dynamics: Revenue

on the revenue side electricity prices are regulated by their local government. the

exact dynamics are quite complicated and

differ from province to province. for

instance in sichuan from november to may,

there is a regulated government price

from june to October. electricity is sold at market in Yunnan, electricity is always sold at market price, unregulated it appears. I guess yunnan is like the texas of china.

i reckon that the utility is losing money when the government sets the price so probably the best way three gorgeous new energy can deal with this uncertainty is to diversify into as many provinces as possible and this seems to be the case so far.

the number of areas with ideal solar and wind properties is limited as more of these get built out the marginal benefit of the next site declines hurting their overall profitability. furthermore the Chinese government has started to work in additional competition into the market. policy makers

are starting to reduce feed in tariffs

for wind and solar which shrinks the

whole pie for everyone in the industry.

three gorges is well positioned here being a state-owned enterprise to develop on the best sites but being an soe is no golden ticket in china.

Comparisons

other companies in this space includes “jinke Technology”, “jiaze new energy”

and “jiangsu new energy” their gross margins are in the same neighbourhood or better but none have

the same size or scale nor are they

backed by a state-owned entity.

out in the united

states it is tough to pin down a close

comparison for three gorgeous new energy. people invest in utilities all the time but these massive companies “southern california Edison”, “pacific gas and electric” and so on are quite old school and are not pure new energy plays anyway.

renewable energy sources might be a significant part of their power generation portfolio but they still rely on non-renewable or hydroelectric power for a big chunk of their revenue.

the closest analog that i can find is “next era energy” partners which is a publicly traded limited partnership subsidiary of next era energy. next era is

one of the largest electric utilities in

the united states and was formerly known

as “florida power and light”.

But you cannot compare this one with three gorgeous because one next era is a limited partnership and there are investor tax implications associated with that clouding the stock's true value and two next era derives a significant portion of revenue from natural gas pipelines. it is not a pure play renewable stock.

Conclusion

IPO in tis the subsidiary was an interesting play by three gorgeous corporations

fundamentally three gorgeous new energy

is a utility company operating in a

favourable macro space. it has a

few key advantages in this space these are capital intensive projects and this company is suited for deploying lots of safe capital thanks to its state ties.

the company is

focusing on a core competency of

developing and operating renewable power

plants. they are trying to build up a

special competitive edge in offshore

wind and possibly offshore solar, but

let's see about that. so, from an operation standpoint they have their differentiation.

CTG the parent

company now has two publicly traded

subsidiaries with strong value for their

investor audiences. Yangtze for those

wanting income and now new energy for

those looking for growth.

Post a Comment

Post a Comment